I'm familiar with this topic, but I'm not here to give you financial advice. Young people have been given a bad rap for being frivolous and living for the moment. There's nothing wrong with the latter because living in the moment matters. However, it's not living in the moment that's the main problem for many; it's more to do with student debt.

Debt isn't much fun as a student, especially when you're trying to juggle finances and deal with so much uncertainty about jobs. However, I don't believe all students are frivolous because the challenges they face are very different from the ones I faced when I was a student.

It's essential to enjoy student life and experience it to the full. However, living in the moment does not cause students to be in debt. Many critics fail to appreciate that student debt is accurate. Plus, it's a headache most students could do without.

Why Are Young People In Debt?

There are many reasons why students are in debt:

❇️Student Loans

❇️Money Management

❇️Lack of advice and Support

❇️Crippling Student Debt

❇️Long-term implications Financial and career decisions

❇️Aim Low Instead of Aim High

❇️Impact Debt Have On Students

Unfortunately, it impacts every decision they make during and after leaving college. How? If a student's financial self-esteem is low, they will:

❎Think short term

❎Exist instead of thrive

❎Constantly worry about how to pay the bills/make ends meet

❎Depression

❎Anxiety

❎Stress

❎Impact on relationships

❎Impact on their Mental health

Imagine the following: This is a true story, and I've changed the name of the individual

Jackie worked seven days a week. She worked full-time in a marketing agency in central London from Monday to Friday. Then, she worked the weekend in a retail store in Chelsea. Why? She was paying off her student debt. She undertook advanced studies and had to pay high fees.

It took its toll on Jackie because she had no time for herself. This impacted her well-being, mental health, and ability to cope with unexpected financial curveballs. She was determined to reduce her debt and focus on getting onto the property ladder.

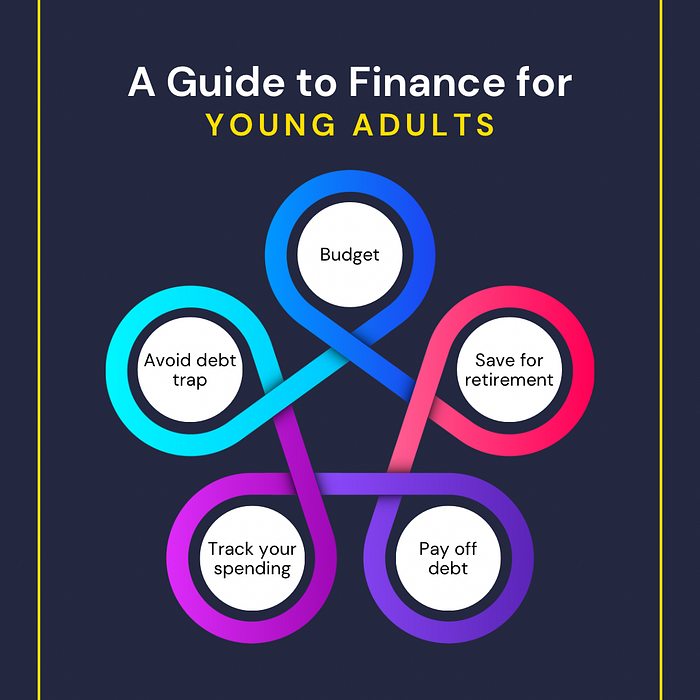

Fast forward a few years. Her student debt has decreased considerably because Jackie was determined to pay as much down as possible. She made a budget, and she stuck to it. She's also starting to think about a side hustle because she knows one source of income won't be sustainable in today's world. What did Jackie learn from this experience? Money management is essential, and so is discipline.

Financial Literacy

It's easy to say Financial Literacy should be the government's priority. However, financial literacy begins at home. It should also be taught in schools to give young people better access to information and resources.

I believe the gap is currently being filled by Fin influencers on Social Media, especially on TikTok and YouTube. The videos and clips are well-presented, fun to watch and informative. However, there are no regulatory controls, so anyone with a following can become an influencer for now. Although, each one clearly states they do not provide financial advice.

Parting Comments

Sadly, debt is part of modern life for billions of people worldwide. One particular debt that's worrisome is Student debt. The student debt issue isn't going anywhere anytime soon, and no fairy Godmother can wave a magic wand to make the problem disappear.

However, if you are a student with debt, don't let it overwhelm or consume you. I know it's easy to write about it because I'm not in your shoes. However, addressing the situation and being sensible about your actions is essential. Find help and support wherever possible to help you remain objective about your situation and choices.

Thank you for your attention.

Follow me for more valuable tips.

Pervin

linktr.ee/AimHighLtd